具体描述

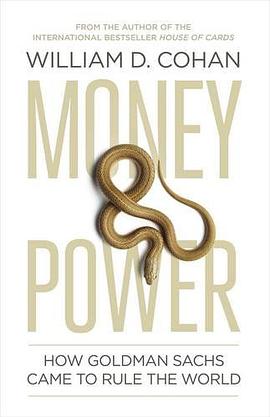

When, in late 2008, the dust finally started to settle on one of the worst financial crises in history, only one Wall Street institution still stood virtually unassailed - Goldman Sachs. Why did Goldman survive, and even flourish, when so many of its peers were collapsing around them? Were the Goldman professionals simply the 'smartest guys in the room', the elite of the elite? Or was there more at work than simply the magic of 'The Goldman Way'? In "Money and Power" William D Cohan peers behind the curtain to give us the inside story of why Goldman is so profitable, and so powerful. His behind-the-scenes account shows how, buttressed by the most aggressive and sophisticated PR machine in the financial industry, Goldman Sachs has continually projected an image of being superior to its competitors - smarter, more collegial, more ethical, more client-focused. But Cohan also reveals another way of viewing Goldman - as a secretive money-making machine that has walked an uneasy line between conflict-of-interest and legitimate deal-making for decades; a firm that has assiduously cultivated power and exerted its influence over government (to the extent that Sidney Weinberg, who ran the firm for nearly forty years, advised presidents from Roosevelt to Kennedy and was nicknamed 'The Politician'); a company kept in line by former CIA operatives and private investigators; and, a workplace rife with brutal power struggles. William Cohan is the first author to chronicle and to interview the leaders of Goldman Sachs since the 2008 crash, and has gained unprecedented access to the firm's inner circle. Every living former chief executive of Goldman Sachs has spoken to him, as well as its current chairman and CEO, Lloyd Blankfein. "Money and Power" is the most penetrating study yet of these larger-than-life characters and their secretive world: the definitive account of an institution whose public claims of virtue look very much like ruthlessness when exposed to the light of day.

作者简介

威廉 D. 科汉

William D. Cohan

《纽约时报》畅销书《纸牌屋》和《最后的大亨》的作者,获得2007年年度《金融时报》-高盛年度商务图书奖。他是《名利场》的特约编辑,在《纽约时报》有双周刊专栏,长期为《金融时报》、《财富》、《大西洋月刊》、《华盛顿邮报》和其他报刊撰稿。科汉毕业于杜克大学、哥伦比亚大学新闻学院和商学院,他曾经是一名投资银行家。

为了全面真实地再现高盛,科汉详细阅读了大量的政府文件、法庭案卷、证券交易委员会的存档资料,采访了100多位高盛的客户、对手、领导人、现任和前任雇员,以记者天生的敏锐及小说家的天赋,结合华尔街业内人士的专业知识揭开高盛的神秘面纱。

目录信息

读后感

高盛的丑闻: 高盛一边卖给客户有毒的次级抵押债券,一边对cdo做空,大赚特赚40亿美元,那么高盛“顾客第一”的信条如何维持啊? Yet it was selling them toxic mortgage securities long after it put on the “big short”—a highly lucrative bet against housing in 2006...

评分高盛的丑闻: 高盛一边卖给客户有毒的次级抵押债券,一边对cdo做空,大赚特赚40亿美元,那么高盛“顾客第一”的信条如何维持啊? Yet it was selling them toxic mortgage securities long after it put on the “big short”—a highly lucrative bet against housing in 2006...

评分太长了,好像快六百页吧得。看死个人了。整本书从高盛的发家史一直讲到了2011年次贷危机后的官司缠身,描述了为什么高盛一直被抨击和客户的利益有冲突。但是本书里我印象最深的是三个小细节: 第一个是有关高盛如何力挺自己人的。 高盛的一个合伙人 Freeman被当时的纽约市长Gi...

评分太长了,好像快六百页吧得。看死个人了。整本书从高盛的发家史一直讲到了2011年次贷危机后的官司缠身,描述了为什么高盛一直被抨击和客户的利益有冲突。但是本书里我印象最深的是三个小细节: 第一个是有关高盛如何力挺自己人的。 高盛的一个合伙人 Freeman被当时的纽约市长Gi...

评分太长了,好像快六百页吧得。看死个人了。整本书从高盛的发家史一直讲到了2011年次贷危机后的官司缠身,描述了为什么高盛一直被抨击和客户的利益有冲突。但是本书里我印象最深的是三个小细节: 第一个是有关高盛如何力挺自己人的。 高盛的一个合伙人 Freeman被当时的纽约市长Gi...

用户评价

相关图书

本站所有内容均为互联网搜索引擎提供的公开搜索信息,本站不存储任何数据与内容,任何内容与数据均与本站无关,如有需要请联系相关搜索引擎包括但不限于百度,google,bing,sogou 等

© 2026 qciss.net All Rights Reserved. 小哈图书下载中心 版权所有