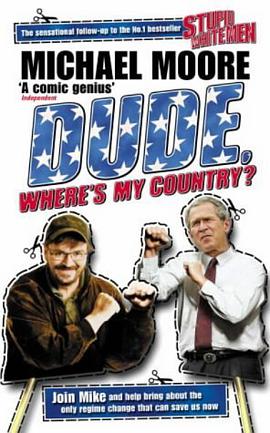

Richard Brealey presents a brief, nontechnical description of current research on investment management and its implications for the investment manager. He covers market efficiency, valuation, and modern portfolio theory in a book that The New York Times noted "rates high as reading for every professional investor."Brealey's easy-to-understand approach to modern investment theory will also prove invaluable to students. The book evaluates the use of technical models and fundamental analysis for common stock selection, examining the implications of the random walk hypothesis, publicly available information, and the efficient market theory. It takes up the valuation of common stocks and reasons for fluctuations in earnings and deals with the choice of a common stock portfolio, discussing how stocks move together, the effect of the market on stock prices, passive and active portfolios, risk and return, and measuring investment performance.Richard A. Brealey is Midland Bank Professor of Corporate Finance and Director of the London Business School's Institute of Finance and Accounting.

具體描述

讀後感

評分

評分

評分

評分

用戶評價

相關圖書

本站所有內容均為互聯網搜索引擎提供的公開搜索信息,本站不存儲任何數據與內容,任何內容與數據均與本站無關,如有需要請聯繫相關搜索引擎包括但不限於百度,google,bing,sogou 等

© 2025 qciss.net All Rights Reserved. 小哈圖書下載中心 版权所有