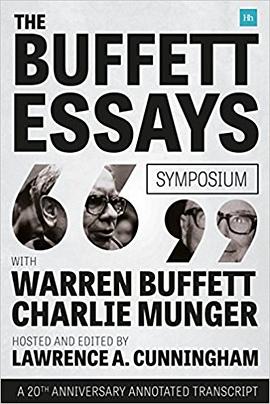

The Essays of Warren Buffett pdf epub mobi txt 電子書 下載2025

Warren Edward Buffett (born August 30, 1930) is an American business magnate, investor and philanthropist. He is considered by some to be one of the most successful investors in the world. Buffett is the chairman, CEO and largest shareholder of Berkshire Hathaway, and is consistently ranked among the world's wealthiest people. He was ranked as the world's wealthiest person in 2008 and as the third wealthiest in 2015. In 2012 Time named Buffett one of the world's most influential people.

Buffett is often referred to as the "Wizard of Omaha" or "Oracle of Omaha," or the "Sage of Omaha," and is noted for his adherence to value investing and for his personal frugality despite his immense wealth. Buffett is a notable philanthropist, having pledged to give away 99 percent of his fortune to philanthropic causes, primarily via the Gates Foundation. On April 11, 2012, he was diagnosed with prostate cancer, for which he successfully completed treatment in September 2012. Buffett is also active in contributing to political causes, having endorsed Democratic candidate Hillary Clinton for president during the 2016 campaign season.

- 投資

- Buffett

- 金融傢

- 金融

- 隨筆

- 英語

- 美國

- 經濟類

The extensive additional content in this second edition underscores topics of vital national or international significance. Some topics have been addressed in letters contained in previous editions by adding important new insights on recent developments; most consider subjects not previously addressed in the first edition. Topic highlights are the following:

? the passion for using independent directors in corporate governance contrasted with inherent limits and often sub-par performance of this cohort, especially in the mutual fund industry;

? the potential value of enhanced powers of audit committees on boards of directors in corporate governance;

? the high costs to investors and the capital markets of extensive reliance on and compensation of intermediaries and high volumes of trading activity;

? the proliferation of stock option compensation and excessive CEO pay (along with public debates concerning proper accounting treatment and political debates concerning standard setting);

? Berkshire?s shareholder-designated contribution program and related political controversy over the abortion issue that led to its termination;

? the explosion of derivative financial instruments and related perils and how Berkshire dealt with managing a sizable portfolio of them after buying Gen Re;

? the dramatic increase in foreign currency trading in the past five years along with the astonishing growth in the US trade deficit and evaluation of resulting national macroeconomic concerns;

? management succession at Berkshire Hathaway as Mr. Buffett ages, along with commentary on his philanthropic thinking in giving his entire fortune to charities coordinated by Bill and Melinda Gates; and

? the fairness and other matters concerning taxation of corporations, including Berkshire Hathaway.

具體描述

讀後感

你会发现巴菲特所投企业的特点: 行业在未来10-20年里面不会有变化, 所投企业拥有持续的竞争力. 确定性的复合增长. 新事物可以成为大赢家, 但是缺乏确定性. 作为个人, 欢迎新东西, 作为投资者, 追求确定性. Coca Cola, See's, Gillette.

評分 評分 評分这本书的中文全称是《巴菲特致股东的信 股份公司教程》,英文名是《The Essays of Warren Buffett Lessons for Corporate America》。书由Lawrence A.Cunningham 编,收录了巴菲特从1979年到2000年给伯克希尔股东的信,并按公司治理,公司财务于投资,普通股的替代品,普通股...

評分用戶評價

*****

评分*****

评分原汁原味,歸瞭類的巴菲特緻股東信精選錄。

评分原汁原味,歸瞭類的巴菲特緻股東信精選錄。

评分原汁原味,歸瞭類的巴菲特緻股東信精選錄。

相關圖書

本站所有內容均為互聯網搜索引擎提供的公開搜索信息,本站不存儲任何數據與內容,任何內容與數據均與本站無關,如有需要請聯繫相關搜索引擎包括但不限於百度,google,bing,sogou 等

© 2025 qciss.net All Rights Reserved. 小哈圖書下載中心 版权所有