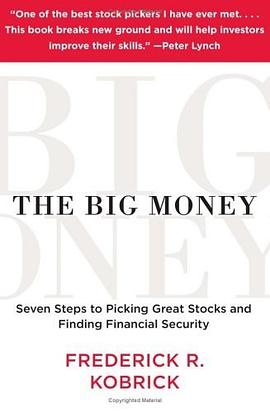

The Big Money pdf epub mobi txt 電子書 下載 2024

簡體網頁||繁體網頁

圖書標籤: 2010 股票 未電 投資 上海 uncheck V++

喜歡 The Big Money 的讀者還喜歡

點擊這裡下載

发表于2024-12-25

The Big Money epub 下載 mobi 下載 pdf 下載 txt 電子書 下載 2024

The Big Money epub 下載 mobi 下載 pdf 下載 txt 電子書 下載 2024

The Big Money pdf epub mobi txt 電子書 下載 2024

圖書描述

In The Big Money veteran stock picker and mutual fund manager Fred Kobrick draws on his decades of success to explain his Seven Steps to financial security in any investing climate.

</p>

Kobrick shows investors how to find the high-quality stocks that will make them wealthy. A stock portfolio needs only a few stocks that appreciate in value ten or twenty times, or one or two stocks that appreciate in value a hundred times or more. Kobrick describes how he found some of his most successful stocks simply by looking carefully at the products and services that customers and investors love, and recognizing the great business models that create repeatability, the ability to keep producing success. This is a timeless approach, so what works with Microsoft, Dell, or Home Depot will work with Google and even newer companies. Kobrick explains that the average investor should not try to emulate a stock analyst or a technician to find great stocks that will generate great wealth. Instead investors must recognize great companies early -- by understanding their business model, identifying their assumptions, recognizing their business strategy, and evaluating their management. Kobrick calls those four factors BASM, and they are the cornerstone of his investing philosophy. Great managements grow companies and earnings, driving stock prices higher. Kobrick also offers some tried-and-tested ways to know when you have a winner you should hold, and when you should sell.

</p>

Throughout the book Kobrick describes some of his biggest successes -- as well as a few stocks he missed. His stories about these companies are insightful and frequently entertaining. In bull and bear markets, from retail to high tech, Kobrick has prospered. His stories and his Seven Steps to financial success will show investors what they need to know to do the same thing -- prosper in any investing climate. No serious investor can afford to be without this book.

</p>

著者簡介

圖書目錄

The Big Money pdf epub mobi txt 電子書 下載

用戶評價

這本書短小精悍,乾貨穿插著各種故事讀起來倒也蠻有意思。學到的最重要的東西就是看anual report時需要注意的東西以及判斷是否需要進行價值投資的標準。總的來說不過不失,很適閤入門,而且蠻有趣味性。

評分這本書短小精悍,乾貨穿插著各種故事讀起來倒也蠻有意思。學到的最重要的東西就是看anual report時需要注意的東西以及判斷是否需要進行價值投資的標準。總的來說不過不失,很適閤入門,而且蠻有趣味性。

評分這本書短小精悍,乾貨穿插著各種故事讀起來倒也蠻有意思。學到的最重要的東西就是看anual report時需要注意的東西以及判斷是否需要進行價值投資的標準。總的來說不過不失,很適閤入門,而且蠻有趣味性。

評分這本書短小精悍,乾貨穿插著各種故事讀起來倒也蠻有意思。學到的最重要的東西就是看anual report時需要注意的東西以及判斷是否需要進行價值投資的標準。總的來說不過不失,很適閤入門,而且蠻有趣味性。

評分這本書短小精悍,乾貨穿插著各種故事讀起來倒也蠻有意思。學到的最重要的東西就是看anual report時需要注意的東西以及判斷是否需要進行價值投資的標準。總的來說不過不失,很適閤入門,而且蠻有趣味性。

讀後感

1/波涛在《证券市场的风险与心理》中对欧内尔的canslim法则有评价,称“有严重的逻辑缺陷”,称混淆了相关关系和因果关系。kobrick总结的basm是不是也存在这样的缺陷? 2/事后回头分析沃尔玛、分析麦当劳、分析微软,都符合basm原则,那么按照这个原则去寻找下一个回报十倍以上...

評分 評分1/波涛在《证券市场的风险与心理》中对欧内尔的canslim法则有评价,称“有严重的逻辑缺陷”,称混淆了相关关系和因果关系。kobrick总结的basm是不是也存在这样的缺陷? 2/事后回头分析沃尔玛、分析麦当劳、分析微软,都符合basm原则,那么按照这个原则去寻找下一个回报十倍以上...

評分有点可借鉴价值。 不过,我还没完全接受 还是比较喜欢巴菲特的东西。成长和价值,不是分裂的。 系统怎么老提示,评价太短啊?本来就这么简单的评论,何必画蛇添足。莫名其妙 作者: (美)科布里克 著,刘强,周佳 译 isbn: 750861710X 书名: 大钱:挑选优秀成长股的7条法则 页...

評分《大钱》 0.BASM B.business model, A.assumptions, S.strategy, M.management 1.知识 耐心 原则 情感 投资期 市场时机 基准。 2.对企业越了解就越赚,越赚就越想了解更多。 3.加以控制的贪婪是积极因素+耐心+时间。 4.识别优秀的CEO,理解最佳经营模式。 5.投资一批小型、快速...

The Big Money pdf epub mobi txt 電子書 下載 2024

分享鏈接

相關圖書

-

John Neff on Investing pdf epub mobi txt 電子書 下載

John Neff on Investing pdf epub mobi txt 電子書 下載 -

暨陽書緣 pdf epub mobi txt 電子書 下載

暨陽書緣 pdf epub mobi txt 電子書 下載 -

元末新州大戰筆談 pdf epub mobi txt 電子書 下載

元末新州大戰筆談 pdf epub mobi txt 電子書 下載 -

榮德生與企業經營管理(全二冊)(繁體版) pdf epub mobi txt 電子書 下載

榮德生與企業經營管理(全二冊)(繁體版) pdf epub mobi txt 電子書 下載 -

"永久黃"團體檔案匯編(套裝上下冊) pdf epub mobi txt 電子書 下載

"永久黃"團體檔案匯編(套裝上下冊) pdf epub mobi txt 電子書 下載 -

招商局珍檔 pdf epub mobi txt 電子書 下載

招商局珍檔 pdf epub mobi txt 電子書 下載 -

招商局與重慶 pdf epub mobi txt 電子書 下載

招商局與重慶 pdf epub mobi txt 電子書 下載 -

英國福公司在中國 pdf epub mobi txt 電子書 下載

英國福公司在中國 pdf epub mobi txt 電子書 下載 -

乾泰隆商業文書 pdf epub mobi txt 電子書 下載

乾泰隆商業文書 pdf epub mobi txt 電子書 下載 -

海爾的高度 pdf epub mobi txt 電子書 下載

海爾的高度 pdf epub mobi txt 電子書 下載 -

跨國攻略與領導之道 pdf epub mobi txt 電子書 下載

跨國攻略與領導之道 pdf epub mobi txt 電子書 下載 -

産品創新36計 pdf epub mobi txt 電子書 下載

産品創新36計 pdf epub mobi txt 電子書 下載 -

海爾是海 pdf epub mobi txt 電子書 下載

海爾是海 pdf epub mobi txt 電子書 下載 -

海爾 pdf epub mobi txt 電子書 下載

海爾 pdf epub mobi txt 電子書 下載 -

海爾人話海爾 pdf epub mobi txt 電子書 下載

海爾人話海爾 pdf epub mobi txt 電子書 下載 -

首席執行官 pdf epub mobi txt 電子書 下載

首席執行官 pdf epub mobi txt 電子書 下載 -

中國企業的先進製造模式探索 pdf epub mobi txt 電子書 下載

中國企業的先進製造模式探索 pdf epub mobi txt 電子書 下載 -

The Haier Way pdf epub mobi txt 電子書 下載

The Haier Way pdf epub mobi txt 電子書 下載 -

嚮傳統管理說不 pdf epub mobi txt 電子書 下載

嚮傳統管理說不 pdf epub mobi txt 電子書 下載 -

孫正義 pdf epub mobi txt 電子書 下載

孫正義 pdf epub mobi txt 電子書 下載