在线阅读本书

Book Description

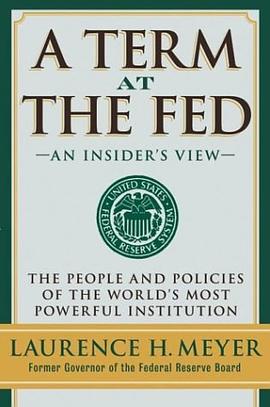

As a governor of the Federal Reserve Board from 1996 to 2002, Laurence H. Meyer helped make the economic policies that steered the United States through some of the wildest and most tumultuous times in its recent history. Now, in A Term at the Fed, Governor Meyer provides an insider's view of the Fed, the decisions that affected both the U.S. and world economies, and the challenges inherent in using monetary policy to guide the economy.

When Governor Meyer was appointed by President Clinton to serve on the Federal Reserve Board of Governors in 1996, the United States was entering one of the most prosperous periods in its history. It was the time of "irrational exuberance" and the fabled New Economy. Soon, however, the economy was tested by the Asian financial crisis, the Russian default and devaluation, the collapse of Long-Term Capital Management, the bursting of America's stock bubble, and the terrorist attacks of 9/11.

In what amounts to a definitive playbook of monetary policy, Meyer now relives the Fed's closed-door debates - debates that questioned how monetary policy should adapt to the possibility of a New Economy, how the Fed should respond to soaring equity prices, and whether the Fed should broker the controversial private sector bailout of LTCM, among other issues. Meyer weaves these issues with firsthand stories about the personalities involved, from Fed Chairman Alan Greenspan to the various staffers, governors, politicians, and reporters that populate the world of the Fed.

From Publishers Weekly

Meyer was appointed to the Federal Reserve Board by President Clinton in 1996, and his term coincided with some of the most momentous economic events of the second half of the 20th century—the collapse of the Asian banking system, the implosion of the Russian economy and the birth and death of the so-called New Economy. Meyer was at the center of global financial policy making and witness to the inner workings of arguably the most powerful government agency in the world. Unfortunately, too much jargon and unrelated personal anecdotes clutter the text; Meyer stumbles from blithe personal asides ("I figured that if I didn't faint or throw up on the President, the nomination was mine"). He is strongest at summarizing complex macroeconomic theory and practice. His breezy style helps unlock the mystery of national monetary policy and global finance. A mystery unsolved is that of Fed Chairman Alan Greenspan, who is the central figure of the book. Though in close contact with him for six years, Meyer offers no more insight than one might find in a weekly news magazine. While broadly informative and certainly unique, the book represents an opportunity lost. Illus.

From Booklist

Meyer served as a governor at the Federal Reserve Board, one of the most powerful financial institutions in the world, from June 1996 through January 2002. Led by chairman Alan Greenspan, the Fed determines monetary policy for the U.S., shaping the direction of the economy primarily through the control of interest rates. Meyer provides a rare inside look at the workings of the Fed, detailing actual discussions from FOMC meetings, where highly anticipated changes to the Federal Funds Rate are debated. (Transcripts from these meetings are sealed for five years.) Meyers was one of the more colorful and outspoken members of the Fed during his tenure. Called to a Senate hearing, he had no problem engaging in a loud outburst with a senator who vehemently disagreed with his views. Although his professional relationship with Greenspan was always quite supportive, the enigmatic chairman revealed little of his personal side to board members. The Fed is today's equivalent of a high priest temple, and Meyer manages to demystify the processes and coded language surrounding it.

David Siegfried

Book Dimension

Height (mm) 241 Width (mm) 165

具体描述

作者简介

目录信息

读后感

评分

评分

评分

评分

用户评价

相关图书

本站所有内容均为互联网搜索引擎提供的公开搜索信息,本站不存储任何数据与内容,任何内容与数据均与本站无关,如有需要请联系相关搜索引擎包括但不限于百度,google,bing,sogou 等

© 2025 qciss.net All Rights Reserved. 小哈图书下载中心 版权所有